Market Update Fall 2023

Well, if it hasn’t been obvious to you yet, the MLS came out with its monthly report, and this time it is not filled with good news. Or, is it?

The financial mage Warren Buffett once said, “It is wise to be fearful when others are greedy and to be greedy only when others are fearful.”

You may be thinking, “Brad, but what in the world do you mean? We are talking about housing and Warren was referring to buying companies. How do these correlate? Interest rates are comparatively high so why in the world should I think of buying a home right now?!”

Here is how I look at it. I believe now is a great time to buy in the greater Seattle Metropolitan area, not excellent and not bad, but great, and here is why.

Anyone who has bought a house in recent years… you know, just the last few, like between 2010/11 and now in 2023, knows the pain of being a homebuyer trudging through property after property only to fall in love again and again at the start of their home search, only to become war-worn over time, after writing offer after offer and coming up against cash buyers, escalation clauses and multiple offer scenarios – some exceeding over 40 offers per house. It was unfathomable and unsustainable. Everyone was exhausted. I was overworked and the dollar value of a single work hour of my time became unsustainably low. It would take me months packed with very long hour days, or sometimes years of working with a client to get them into a home.

To many of my clients, I was their broker, their cheerleader, their visionary, their pragmatist – leaning toward practical considerations rather than ideals, their relationship counselor, negotiator, and economist. Oh the memories, we’ve been through a lot together, and I love y’all!

I am also a facts guy. I don’t like assumptions, I prefer factual information and one way of getting to the facts is by looking at the picture from many angles.

So, back to the topic at hand. Right now, with the interest rates bumping higher I see an opportunity for those who are in need of buying a home or are in a position to purchase but holding off because “logic” would say they should wait until rates drop again.

One problem with crowd mentality is that almost everyone is thinking the same way. Think of the real estate market as a huge echo chamber made up of people all thinking the same thing and you can easily extrapolate why it may not necessarily be the thing to do all the time.

Since 1971, the year of my birth, the Government Sponsored Enterprise, Freddie Mac, has tracked the monthly history of interest rates. You will see that we really are not that bad off as a clear majority of history shows that interest rates were much higher with an ominous Friday, October 2nd, 1981, the Reagan years, at an astronomical high of 18.53%.

All the zigs and zags in the chart above, are month or intra-month points in time, where the interest rate was. As you can see, they move a lot in an up-and-down motion. This is a testament to the fact that rates change constantly.

Mortgage interest rates are based on a multitude of factors which I will save for another post, but you can see that they are going up and down so they will continue to move up and down.

Today, rarely do people keep a mortgage (or a home for that matter) for the entirety of the original loan period, most commonly a 30-year payment plan. So what do those people do? Well, some sell, some refinance. Some refinance multiple times when the economic opportunities present themselves.

Now that you have that information, you can see that you are marrying the house, not the interest rate.

So if you think about it with this viewpoint in mind, you can see that buying when there is less competition could be advantageous for you. Yes, you will be paying more in interest on your loan while rates are high, but take a look at the chart above and you will see the big picture and potential. Plus, if you are currently a tenant you should factor in the truth that 100% of your rent is thrown away and you get no value appreciation and no tax write-offs.

All that being said, are you ready to dive into some current market statistics?

We are heading into fall and many home buyers are experiencing the echo chamber effect of holding off until rates improve. Across Washington communities, we are seeing a decline in the number of transactions and a mild to modest year-over-year increase of median prices within communities.

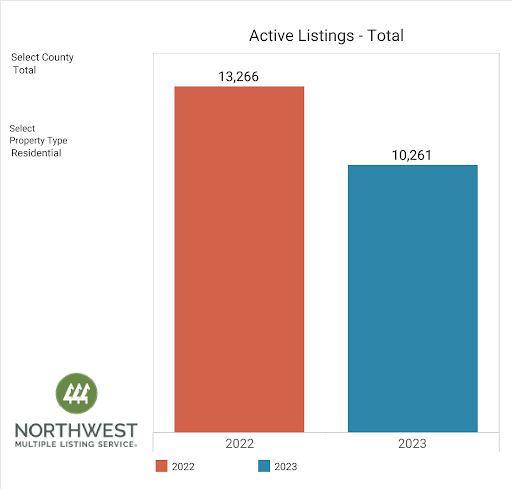

Statistics are showing a 20% year-over-year decrease of Active listings in September 2022 and September 2023 in all counties covered by our Northwest Multiple Listing Service.

Now, the real estate market usually slows down in the fall and winter months however this market with higher interest rates has decreased the purchasing power of prospective buyers which also contributes to a stagnation of median prices and of course the year-over-year decline in transaction volume.

We have a bottleneck of people who want and need to buy homes so you sellers should not be in dismay.

To deep dive into your own situation and needs, please reach out to me to schedule a no-cost, no-pressure meeting with our team.